Caterpillar’s stock is down in 2022. This Dividend Aristocrat continues to show signs of undervaluation, especially after we run the company through our dividend stock screener. This article will review the company’s 2022 performance and answer one simple question…is Caterpillar’s stock price too cheap to ignore?

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts such as Yotta (1% – 2% APY, on average) or SoFi (Earning 1.50%). If you are looking to earn more on your cash, it is definitely worth checking those products out!

Read: How to Earn More on Your Savings Account – What I’m Doing Today!

Building a dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

That’s why we are always looking for undervalued stocks to buy using our stock screener. You can’t ever own too many undervalued dividend stocks, right?!

Caterpillar Stock: What Is Going on in 2022?!

This has been an interesting year for Caterpillar. From a stock performance standpoint, the company is down 16% year to date. Although the company is slightly outpacing the S&P 500. The overall market is down 20% YTD at this time.

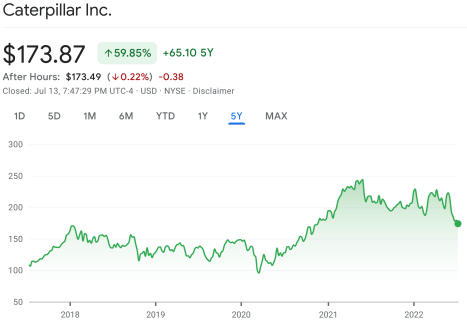

Although for fun, why don’t we zoom out to see the company’s performance over a longer period of time. 2022 is telling, as they have cooled off from the company’s 52 week highs. Let’s see how Caterpillar has performed over the last 5 years though!

Now, if you stretch out the company’s performance, you can see that Caterpillar has CRUSHED IT over the last 5 years. The company’s stock price is up 60% over the last 5 years. The S&P 500 has increased 55% over the same 5 year period. In both cases, Caterpillar has performed pretty much in line with the market.

Caterpillar last released earnings at the end of April. It will be very interesting to see the impact inflation is having on the company’s revenue. Are major construction projects getting cancelled, hurting revenue? Are their costs going to shoot through the roof this quarter? It will be fascinating. On a positive note, will the massive infrastructure bill flex some muscle in this company’s quarterly results.

Looking at last quarter, the results were great. Q1 revenues increased 14% to $13.6 billion. Earnings per share increased as well. The predominant revenue increase driver was increased inventory and purchases from the company’s dealers. That trend was a benefit in Q1. However, will it hurt the company’s results in Q2? We shall find out in a few weeks.

Despite some uncertainty, Caterpillar still managed to announce a strong dividend increase in June 2022. The company increased its quarterly dividend 8.1%. The company’s new quarterly dividend is $1.20 per share.

Dividend Diplomats Dividend Stock Screener

Time to run Caterpillar through the Dividend Diplomats Dividend Stock Screener. We use 3 SIMPLE metrics to evaluate every dividend stock. The goal of our stock screener is to identify if a stock is an undervalued dividend growth stock to buy.

Watch: Our Simple, 3 Step Stock Screener

Here is a rundown of the 3 metrics of our stock screener:

1.) Price to Earnings Ratio Less than the S&P 500. Currently, the S&P 500 is trading at a P/E Ratio of 19X. This continues to slide from the mid 20s range that we saw just a few months ago. Man this has been a crazy 2022.

2.) Dividend Payout Ratio Less than 60% (Although we think a perfect payout ratio is 40% – 60%). The payout ratio measures the safety of the dividend. This ensures the company can continue growing its dividend during good times and bad. That’s why it is a critical metric in our stock screener that we must evaluate!

Read: Dividend Aristocrats with a PERFECT Dividend Payout Ratio

3.) History of Increasing Dividends. We review this metric by reviewing the company’s five-year average dividend growth rate and consecutive annual dividend increases. Since we are long term investors, it is important that a company increases its dividend consistently!

Bonus: Dividend Yield. We like to also throw in a bonus metric to our dividend stock analysis. Yield does not drive our decision; however, we would be lying if we said we completely ignore dividend yield.

How Does Caterpillar (CAT) Perform in Our Stock Screener?

For this analysis, we will use Caterpillar’s stock price $173.87 (June 13, 2022 close). Analysts are projecting forward EPS of $12.44 per share. The company’s annual dividend is $4.80 per share. Now that we have the inputs for our analysis, let’s dive into the results.

1.) Price to Earnings Ratio: 13.97x.

2.) Dividend Payout Ratio: 38.5%.

3.) History of Increasing Dividends: Caterpillar is a Dividend Aristocrat and the company has a five year average dividend growth rate of 7.82%

4.) Dividend Yield: 2.76%

Summary

Caterpillar is going to shoot up my watch list after the results of this dividend stock analysis. However, I’d love to see the company’s yield above 3% before adding to my wife’s current position. In order for that to happen, the company’s price would need to fall to $160 per share. That is definitely possible given this crazy stock market and the ever changing landscape. If it belows $160 per share, I may have to add at least one share.

What are your thoughts about Caterpillar? Are you currently buying this dividend aristocrat? If not, what other stocks are on your watch list?

Bert

I own 200 shares of this stock. I’m at a point in my life where my dividends could cover all of my expenses. However, since I don’t need the money to cover them I just keeping reinvesting my dividends.