Can we say the best month in dividend income I have ever received? Let me repeat that – NEW DIVIDEND INCOME FOR THE MONTH RECORD! I am so fortunate to be able to talk and write about the production from my cash flowing, dividend producing portfolio. I was very excited to go into the month of June, as many other bloggers were aware based on the comments from their posts. With all of that being said, let us take a look at the month’s recap of the June dividend income I received:

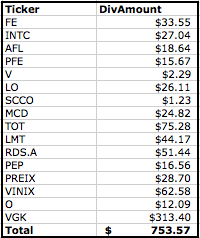

June: I received a total of $753.57 of dividends broken out by the following:

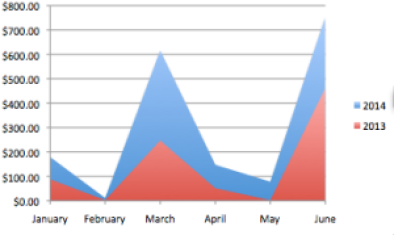

Drumrolls… I seriously can’t believe it. Last year I received $462.52 in dividend income – which by far – was my best month last year. This year, however, I received $291.05 or 63% more in dividend income! I think this really makes me sit down and say – as long as you continue to invest, that you will reap the benefits of what you sow. In this wild market, where valuations are rising higher and higher, as more and more gets pushed into the market via individuals and the FED, though slowing down, is still purchasing bonds – just makes it hard to find the right purchases. Even so, I purchased TGT this month from the research and analysis performed, which allowed me to cross the $100K mark, helping add to the total dividend income projection.

The tough part looking at this, however, is the $313.40 from VGK – an international ETF. It is within my Roth IRA and I will not be touching this account until 59.5. Therefore, the dividend income from there does not allow me to use it today or next year or ten years from now. However, as I said in my Max Out Your Roth to Set and Forget – owning this ETF allows me to reduce the amount of years of investing into a Roth to use those funds in my individual taxable account.

With this $753.57, to be conservative lets say this is 3.50% yielders –> this will add over another $25+ to my annual dividend income just via re-investment alone. I think this is key to remember, we are dividend reinvesters – and those dividends re-invested back into those stocks/funds are owning more shares, which produce dividends and majority of increase their dividend annually to produce more income, etc., etc.. – Clockwork baby! That is the fun part. Your portfolio income is increasing without you having to do a single thing. Just to maintain your research time on the company(s) that you own to ensure they are still fundamentally sound and you will succeed and do well.

Okay – enough about me preaching and about my month. Are you hitting record months? What are you seeing in the market place? Trend in your portfolio? How are you with your goals? This is my favorite time of the month – investment summaries, dividend income breakdowns and goal re-caps. Its a great time to assess your position, situation and see if there are any moves to make to change where you are to stick on your path or to jump over it if you’re feeling aggressive. Fear anything coming forward? Let’s hear it – please post below! Thank you again for visiting, extremely excited for the next 6 months, let the good times dividends roll!

-Lanny

Good stuff, DD. Thats some serious jump from the previous year. Congrats on the dividend income. I hope to reach those kind of numbers some day.

R2R

RM2R,

Thank you for recognizing the jump – I think that’s a fun part to see – I know with my 9-5 job, I definitely am not making 60% more in a single month..

Also – the tax rates on dividend income play in our favor, for now, so trying to play those cards rather than W2 income down the road would make sense for us. You’ll hit those numbers roadmap, just stay at it, you know you will get there.

-Lanny

Good job reaching your new record! Next year it will be $ 1000!

Dutch,

Thank you! $1k in a month would be unreal – but what is funny – I KNOW I will get there. Persistence is key! Thanks for stopping by. Hope you’re having a nice weekend!

-Lanny

Great job! The increase in dividends is always fantastic to see! And the great part is the increase will probably be more next year too!

Living at Home,

Thank you for stopping by! The increase is great and I have confidence it will continue down that same track. I am sure 4 figures on a few months next year is not out of reach at all, looking forward to it.

-Lanny

Congrats! Hope to see a month like that myself one day. I guess I still have some work to do.

DearDiv,

Dont say one day! YOU WILL SEE IT. I promise you that. Persistence and discipline is key, do more now rather than later and pushing yourself to new extremes is key. You can do it and I’ll be excited and ready to read about it as well. Thanks for stopping by deardiv!

-Lanny

DD,

Super solid month! That’s a nice group of companies paying you in June. I look forward to seeing next month’s results. Don’t worry about the Roth Account, you will need passive income after 59 1/2 too!:-)

MDP

MDP,

Thanks for the stop by! I agree – passive income will always be needed and hopefully that $313 will have a few more zeroes to tag along the side of it. So you have more in July than June? That’s awesome – I’ve been trying to build around the off month with other dividend paying companies. Excited to see your July results then as well. Thanks again!

-Lanny

Congratulations on a record month, that’s great news and I hope to be reading about your next record month in September!

I wouldn’t recommend buying any company stock based on their dividend schedule, it limits your choices too much and you may end up with a lower quality pick. I used to worry about how to balance out the lower paying months (pretty much all months except March, June, September and Dec). But you should focus only on company quality, value, future growth etc. and let the company worry about when they pay dividends. If you budget well, it’s not even a factor.

DL,

Reflecting on your comment – you are right, without a doubt. It’s nice when thorough research and analysis does show a company that pays on the “off” month schedule, but the off month schedule should not be a reason to purchase solely. I hope September does shock me and shows over $750 – something my projections didn’t even pick up. Reason for this to be unexpected is – I own that ETF that the dividend does vary widely, but I think with having more information now, that I’ve adjusted my annual income off of it accordingly. Thank you again for rolling on by and cheers to the next half year waiting for us!

-Lanny