Dividend investing is STRONG and BACK baby! There is deep value out there in the stock market, to juice up your dividend stock portfolio. Many dividends stocks are out there to buy right now, as the stock market is down over 850 points in the S&P 500 heading into July 2022.

In addition, dividend increases have been a plenty. Dividend investors can argue that 2022 has been another fantastic year for dividend investors, despite inflation, a rising interest rate environment with the great resignation happening.

Therefore, as I do every month, here is the Dividend Stock Watch List for July 2022!

Dividend stock watch list

Another dividend stock watch list! The stock market has been more volatile than ever since the pandemic of 2020. What does that mean? New undervalued dividend stocks are coming to light baby! It’s all about buying dividend income producing stocks – the best source of passive income source on your journey to financial freedom!

The stock market, specifically the S&P 500, is below 4,000, still! From the all-time highs of 4,800, dropping below 4,000 and holding steady now above 3,900. We were in recent bear territory, but have come back up from being down over 20%. What a volatile time period we are in! Chart is below:

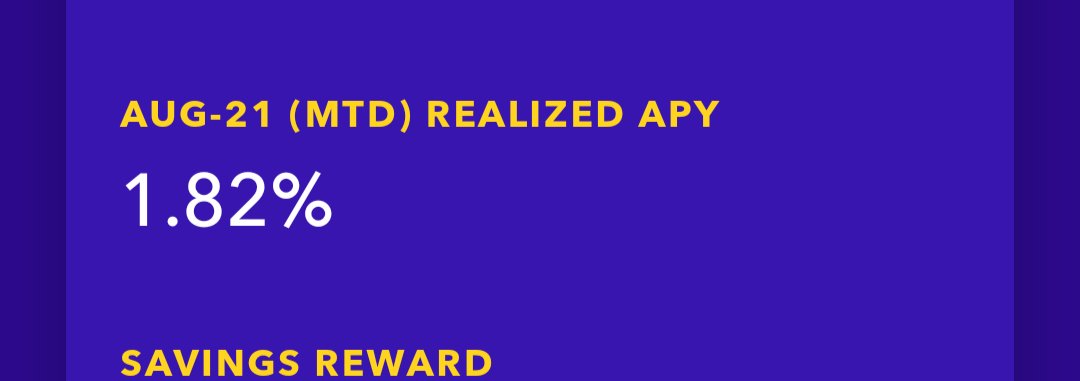

Interest rates are still low on your savings, including high yield savings, accounts, as well as money market accounts & funds. However, rates are rising, now that the fed has increased the fed funds rate by 75 basis points. Ally, where I hold a significant amount of cash, is yielding 1.00%, but I am using two accounts to boost my APY, one is SoFi, which offers a 1.25% checking and savings account, as well as Yotta.

I keep MORE savings in my Yotta Savings Account, that has earned consistently over 1.50% APY and earned over 2% in May 2022 and well over 2% in June 2022. The account is FDIC-insured, of course. Definitely sign up if you want to have fun and earn more yield on your savings account!

Related: Sign Up For Yotta Savings

What else has been going on? I have been investing more and more into Fundrise, as of late – finally crossing over $10,000+ invested there. See my Q3-2021 review. In addition, I have been LOVING the SoFi financial app and platform. In fact, check this article out, as I showcase how SoFi has helped me build wealth this year. You can earn bonus money for opening an account, as well as free stock! Definitely check it out.

As a dividend stock investor, it’s been harder and harder to find an undervalued dividend stock.

See – Why I Don’t Time or Predict The Market

In addition, given the uncertainty, I continue to make smaller, weekly investments into Vanguard Exchange Traded Funds (ETFs). The specific ETF my wife and I have been loading up on is Vanguard High Dividend Yield (VYM). We are investing approximately $400-$500 per week into Vanguard (pending the VYM stock price), to stay invested in the market, during the uncertain times. In addition, I am also investing $50 per day into Vanguard S&P 500 ETF (VOO)!

Related: Why I’m Investing $500 Weekly with Vanguard ETFs

Related: Dividend Investing Strategy Added – BUYING $50 per day of VOO

Therefore, on the road to financial freedom, acquiring assets that produce cash flow or income is the goal! Like I always say, there is always a diamond in the rough. How do I find an undervalued dividend stock? Time to introduce our beloved Dividend Diplomat Stock Screener!

Dividend Diplomat Stock Screener

If you don’t know already, we keep the stock screener metrics to THREE SIMPLE items. They are:

- Price to Earnings Ratio – We look for a price to earnings ratio < than the overall Stock Market.

- Payout Ratio – We aim for a payout ratio between of less than 60%.

- Dividend Growth – We like to see history of dividend growth in a company.

See the video below, for further details and explanation. If you don’t like to watch videos – see our Dividend Diplomat Stock Screener page!

Time to find the answer to… how did the dividend stocks on my watch list grade on the stock screener?

Dividend stock watch list

Here is the list of dividend stocks that are on my radar going into the month of July 2022. I typically like to keep it at 2-3 dividend stocks, keeping the focus locked in. Finding dividend stocks isn’t easy, but there are also other factors, such as composition of my portfolio by industry (such as – am I overweight/underweight in an industry), as well as exposure to one stock and the concentration there.

There, the dividend stocks on my list cater to those other facets when building a dividend stock portfolio. This is a fairly defensive, consumer-goods intensive, dividend stock watch list!

Kroger (KR)

Kroger (KR) is a supermarket store, that is based in Ohio. They now have over 2,500+ stores, operating in over 35 states across the country. Warren Buffett has also been a shareholder of this company, though he has recently been selling off parts of his position as of late.

Kroger released their Q1 earnings report and sales were up a whopping $3 billion. Net income for Q1 was up over $500 million. Kroger has been absolutely crushing it. Their stock has also taken notice. While the S&P 500 is down almost 20%, Kroger stock is actually up this year, which not too many stocks are.

First, however, we MUST run Kroger through the Dividend Diplomats Stock Screener, which is focused on these 3 metrics.

- Price to Earnings Ratio: Analysts for Kroger stock are expecting earnings per share of approximately $3.91. Therefore, at a stock price of $48.45, taking that over the $3.91, you are actually at a low price to earnings ratio of 12.39x. That’s lower than the S&P 500, which is trading near 20x earnings.

- Payout Ratio: The beauty and safety to the dividend! We like to see a dividend payout ratio below 60%. Kroger, whom recently announced a MASSIVE dividend increase, has a safe dividend payout ratio of 26.60%, while paying out $0.26 per share, per quarter or $1.04 per year. Money! Plenty of room to grow the business and the dividend in future years.

- Dividend Growth: Kroger has now been increasing their dividend for over 15 years, WELL on their way to being a dividend aristocrat. In fact, they JUST increased their dividend by a massive 24%! WOW. On top of that, the 5 year dividend growth rate, on average, is 11.92%. Well above the rate of inflation (which is at the highest in 40 years) and is a great combination with their dividend yield.

The dividend yield is at 2.15%, well above the S&P 500 and is a better yield on average than the majority of high quality stocks.

LyondellBasell (LYB)

It comes without question that LyondellBasell will be staying on the dividend stock watch list! They recently announced a 5.3% dividend increase AND a $5.20 special dividend that is coming THIS June! In fact, we also came out with a YouTube video on the news announcement:

I’ve been watching them over the past few years and even buying this stock throughout the last few years. So much, that I even accumulated over 100 total shares of this now.. dividend growth monster! Why are they back on the stock watch list? The stock has dropped by almost $30 since my last article (i.e. last month!!!). Therefore, we definitely need to re look at the dividend stats, of course.

Let’s run them through the Dividend Diplomats Stock Screener and I’ll bring in the statistics from my previous article on why LYB is a dividend growth stock from last month, to save some time.

1.) P/E Ratio: Analysts are expecting $16.78 in earnings for this large chemical company. Based on LYB stock price of $89.24, the P/E ratio is SO LOW at only 5.32. Value Trap? Just…WOW. The S&P 500 p/e ratio is currently 20x earnings. This is insane. Even if earnings were half of the expectation, still a low P/E ratio below 11.

2.) Dividend Payout Ratio: They didn’t land in the “perfect” payout ratio, BUT they are actually better – as it’s lower than the 40%, versus being higher. LYB has an extremely safe dividend payout ratio of 28.37%. Think of it like this – LYB retains 70% of their earnings to develop, invest and research new products and pays out almost 30% of their earnings to shareholders. If earnings were cut in half, the dividend would still be… SAFE!

3.) Dividend Growth Rate: LYB keeps is consistent. Though they just announced a MASSIVE special dividend, the dividend growth rate has trended just under 6-7% over the last 5 years on average. Solid overall.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for LYB is 5.33%. That is higher than the S&P 500 by approximately 350+ basis points. Not too shabby. This is also higher than all CDs and your high yield savings accounts!

Dividend Stock Watch List Conclusion

Dividend investing is real and is happening! Here is our latest video covering a recent, undervalued, dividend growth stock:

Of course, prior to making any purchase, I definitely will make sure to run them through the Dividend Diplomat Stock Screener once more.

Talk about great, every day dividend growth stocks. My order, right now, would be to add LYB under $90 and if Kroger gets below $45, I am there to buy a share or two! Let’s continue to build assets baby!

Related: 5 Reasons Dividend Income is the Easiest Passive Income Source

As you have noticed, I have trickled many articles on this page. The goal is to educate new dividend investors out there, or to sharpen the terminology for current dividend investors. As always, stick to your investment strategy and dividend stocks will be there. What do you think of these stocks above? Thank you, good luck and happy investing everyone!

-Lanny

Thanks for the watch list! I’m considering adding to my positions in VICI, MRK, and MMP next month.