This week was a pretty exciting week for my portfolio. I crossed two major milestones in my portfolio: $35,000 in market value (Now over $37k) and $1,500 in projected dividend income. What’s exciting/crazy is I am one purchase and one crazy week of appreciation away from crossing the $40k mark. It is funny how fast your portfolio can grow. I was able to cross the $35k mark with two purchases last week.

Purchase #1: ~18 shares of T, adding $33 to my projected annual dividend income.

There were two reasons for this purchase:

First, my fellow diplomat recently increased his position in T after the company announced its acquisition of DirectTV. His purchase had me thinking that this was a great opportunity to take advantage of a decrease in the stock price and to purchase additional shares. So I decided to pull the trigger and increase my position.

Second, this was a great opportunity to apply one of the first lessons I learned after we began this blog. Dividend Mantra and I had several comments about purchasing new stock or purchasing additional shares of a company already in your portfolio. After I told him that I am always trying to find a new company to add to my portfolio, he told me that sometimes the best decision is to use excess funds to increase your position in several companies already in your portfolio. His belief was that you already know the company is a solid company, so why not increase your position when there is a down-swing. Sometimes we don’t need to recreate the wheel. I thought this was great advice and I wanted to begin to incorporate the advice into future investing decisions. T provided me with an opportunity and I did not hesitate to pull the trigger this time around.

Purchase #2: 49 shares of HCP, adding $106.82 to my projected annual dividend income

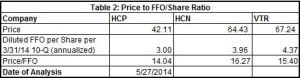

Similar to Lanny, I was also looking to invest in the healthcare REIT sector. However, instead of spreading the love to three individual REITs like he did (Note: I am a big fan of his investments. The reason I did not follow suit is because we had two different objectives with our purchases), I decided to invest in just one of the REITs in the industry, HCP. I performed the following analysis to arrive at my final purchase decision:

About HCP

HCP is an appealing company to me because of its diversification in the healthcare industry. The industry is involved in five healthcare segments and the highest exposure to one segment is 38% (senior housing). The diversification prevents the company from being exposed to any sudden changes in regulations, reimbursements by an insurance company, etc. that could negatively impact the industry. In addition, I am long on the industry as a whole as the baby boomers begin to retire.

Analysis Using the Dividend Diplomat’s Metrics

To assess the HCP’s metrics, I performed a modified analysis of our dividend screener. We assessed each metric as follows:

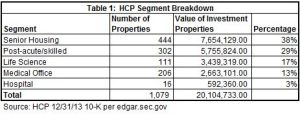

- Price to Diluted FFO/Share analysis. Usually for a company I would compare P/E ratios. However, the REIT industry uses the metric FFO (A non-GAAP measure that adds non-cash expenses such as depreciation and amortization expense back into net income) as opposed to EPS as FFO better assesses the financial strength of a REIT. So I performed a Price to Diluted FFO/share analysis to compare HCP to two of its largest competitors, HCN and VTR. I selected these two companies because the new CEO has mentioned in interviews that she measures HCP’s performance against HCN and VTR. Based on our analysis (Using the 5/27/14 closing price and FFO data from the most recent quarterly filings), we noted that HCP is trading at a discount among its peers.

- Payout Ratio/Earnings Analysis. Usually when I evaluate a dividend stock I will review the company’s payout ratio to assess if a company is paying out too large of a percentage of earnings. However, I needed to change my approach to evaluating HCP since REITs have a minimum payout of 90% of earnings. Since payout is tied directly to earnings, I reviewed HCP’s earnings growth and Diluted FFO/Share over the last three years and noted a steady increase for both metrics over the period reviewed.

- Dividend Analysis. In terms of HCP’s dividend, the company yields about 5% depending on the day. The company is the only REIT to be classified as a dividend aristocrat (29 years of dividend increases). Recently, the annual dividend increase has been below what I typically like to see (3.8% and 5% increases in 2013 and 2012, respectively). The company is committed to maintaining its strong dividend and label as a dividend aristocrat.

Based on our metrics, I would normally consider the company a prime candidate for a purchase. There is just one more item that I had to address before I was comfortable pulling the trigger on HCP: the firing of the company’s longtime CEO in late 2013. Anytime a company fires a long-time CEO that had such a profound impact on the company’s growth the market can justifiably be uneasy. The company’s share price took a dive after the announcement of the firing of the CEO. However, I read an interview between the company’s new CEO Lauralee Martin and Morgan Myrmo (contributor to Seeking Alpha) and left the article very confident in Lauralee’s leadership abilities and her strategic plans for HCP. She discussed her background as a board member of HCP and her experience at other companies working with healthcare facilities. She appears to understand HCP’s operating structure and handled Morgan’s questions about HCP’s competitive advantage very well. While Lauralee still has a lot to prove (As any new leader does), it appears she has the proper skill set to keep the company moving forward.

With all things considered, I ended the week by adding $2,700 to my portfolio and $139 to my projected annual dividend income. What are your thoughts about the investments? Have any of you invested in different Healthcare REITs recently as opposed to HCP or the REITs Lanny invested in (SNH, MPW, SBRA)? Lastly, please provide any feedback about my stock analysis or my purchases. I am always looking to learn.

~Bert, one of the Dividend Diplomats

Disclaimer: I recently purchased the stocks listed in this article. The contents of this post reflect my opinion about the stocks. Readers must perform their own research over the mentioned companies and arrive at their own independent investing decision.

Good pick up on T. HCP looks good but not tax efficient for me as a Canadian.

Thanks for reading. It can’t hurt to add a few extra shares. Enjoy your weekend.

Thanks for the analysis. Will be adding T to my watchlist. HCP is already in my sights.

Thanks for stopping by. Both are great buy and hold companies. I just decided to finally pull the trigger on each.

-Bert